Three Ways Financial Services Enterprise Architects Embrace Dynamic Authorization

A new paradigm for authorization improves security and user experience

The pandemic has accelerated an evolution already underway. Branch banking is declining in favour of digital channels and both businesses and consumers increasingly manage their finances through an expanding list of digital services. To balance convenience and physical health risks, more consumers are using technology daily, including many who previously did little or nothing online. In 2021 two and a half billion users accessed retail banking services through smartphones, tablets, PCs and smartwatches, up from two billion in 2018. More than 76% of UK residents have used online banking in the last year. These figures continue to grow as consumers prefer instantaneous, on-demand apps serviced through digital channels.

As both customers and workforces shift their processes online, expectations for how to interact with services are rapidly changing. Team members now remotely distributed must have access to the financial data that they are authorized for, but nothing more. It must be possible to enforce separation of duties for high risk, sensitive activities. Consumers may wish to share data and account access with family members or third parties, but set appropriate levels of access and spending preferences on an individual basis.

These user trends are driving flexibility in terms of how businesses and teams consume and share financial information and permit operations. However, between strict compliance regulations and ongoing cyber threats, flexibility must be balanced with security. In November 2021, a Robinhood hack exposed more than seven million users' data. Financial services providers must find ways to deliver exceptional, easy-to-use experiences while strengthening security.

Determining who has access to what has become a tier-one priority for financial services organisations. Faced with increasingly complex data security needs, financial service providers are turning to dynamic authorization to increase security and improve the user experience.

Dynamic Authorization and the Growth of Context

Historically, authorization has been solved through the use of role based access control (RBAC) where groups of users are assigned a role that has pre-defined permissions associated with it. As requirements grow, this leads to an explosion of roles or scopes. To accommodate greater flexibility and implement new use cases, application developers have ended up implementing authorization logic into each specific application which is slow to change, invisible and prone to error.

A new model is emerging. Dynamic authorization is the real-time enforcement of the fine-grained business logic around what users can see and do, in what context, and for what purpose. It isn’t based on static role-based logic like role based access control (RBAC). Instead, it recognizes that an authorization decision will often leverage numerous other data sources and risk signals to determine whether access is properly permitted. The context of a transaction has more importance. Authorization policies assess more than a single attribute, like roles, and look at multiple attributes – time, location, type and size of transaction, data being accessed, and so on. Dynamic Authorization solutions evaluate the latest data available and make an access decision at the time of the transaction.

Fundamentally, then, Dynamic Authorization goes beyond identity to determine who can access what. Many products extend RBAC, which is limited to expressing the relationship between roles, resources and actions. Dynamic, or external, authorization goes beyond RBAC - beyond identity - by utilizing additional attributes for authorization decisions for enhanced flexibility and security. It builds on attribute-based access control (ABAC) to use fine-grained access control and take authorization outside applications. The context is evaluated for each access request, providing flexibility traditional authorization lacks.

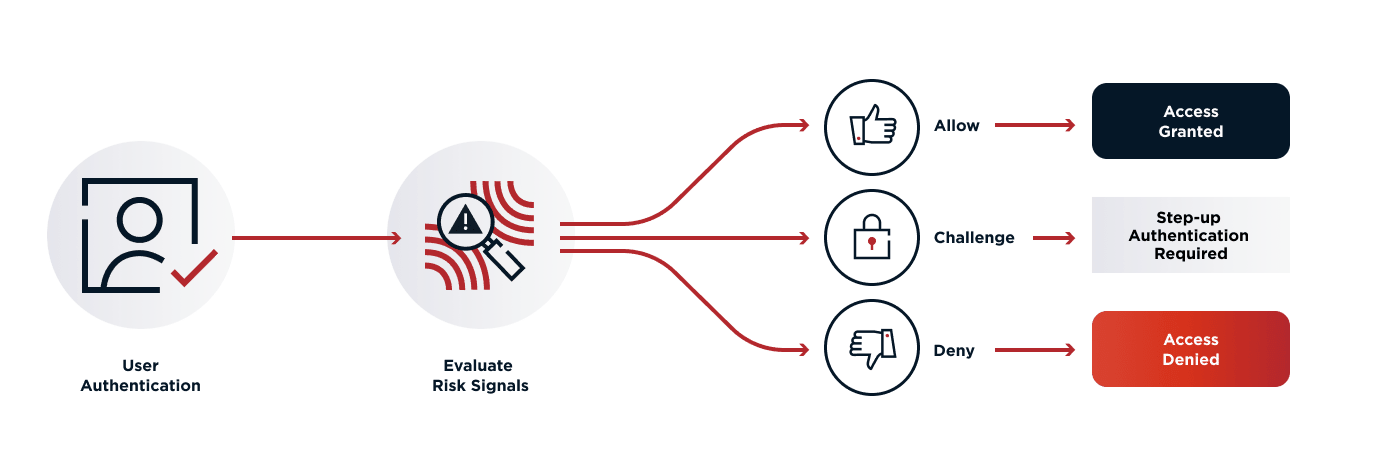

Dynamic Authorization allows us to make more informed and intelligent authorization decisions, and to make those decisions closer to the point of access. We are then able to tailor how applications behave based on the context of the request: for example, if a transaction is associated with a higher level of risk then we can require the user completes a step-up Multi-Factor Authentication (MFA) process before they can proceed. In this way we can adjust the user experience based on the user, the resource and the information we utilize at the point of access.

An ABAC approach extends beyond the basics with flexibility to solve most use cases. Financial services have diverse decisioning requirements, and flexibility of expression and data modelling is key to success.

Top Three Use Cases

Let’s explore three use cases that Ping Identity’s financial services customers adopted in 2021 to improve security and their clients’ experience:

Fraud Prevention

Digital banking fraud is a growing threat and more incidents equal increased costs. Criminals gaining access to a customers’ online accounts and making unauthorized transfers grew by 43% in 2020 and cost £159.7m in the UK alone.

Financial services organizations are constantly reviewing the security measures and are now moving from detection to real time mitigation. However, there is broad recognition that this cannot come at the expense of delightful experiences for legitimate customers. To achieve the correct balance, successful organizations are focusing on trust and safety without putting additional security measures on all users.

How are they doing it? Establishing trust involves processing a mixture of signals throughout the user’s journey. These signals may come from fraud and risk services, or information about the user, device and action being performed. The user may be directed to different user experiences depending on the trust level (for example, to require MFA for certain transactions if the trust level is low). The intent is to provide an appropriate level of friction for the action that the user is performing.

Dynamic authorization allows fraud team members to assimilate signals from across the organization and craft policies that determine the user journeys for different trust levels. By lifting the authorization policy out of applications and into a shared, centralized user interface, fraud teams can quickly introduce new signals as they become available and experiment with how these signals are applied and enforced against different user journeys. They are no longer tied to slow IT release schedules, which enables them to get ahead of fraudsters as they spot emerging threats. This is allowing financial services organizations to constantly adapt their experiences appropriate to the trust level associated with the individual user.

Consent Management for Open Data Regulations

As consumers adopt digital services, they are looking for mechanisms to use and move their data between services in ways that benefit them. A growing number of consumers are sharing their financial data through screen scraping services to gain access to innovative financial services products. Screen scraping is the automated, programmatic use of a website, impersonating a web browser, to extract data or perform actions that users would usually perform manually, such as Mint.com or Plaid.com that automatically collect banking data on your behalf to present a consolidated view. However, screen scraping presents consumers with security risks as it requires them to share their banking login credentials with third party service providers.

It’s risky to store users’ credentials. Many users reuse passwords across accounts, and breaches can compromise bank accounts and other online accounts. The only way to revoke access is by changing passwords and most people don’t remember which sites and apps they’ve given access to, or what level of access they’ve provided. Furthermore, the user experience and functionality of screen scraping is frequently disrupted when financial services providers make minor system changes.

There is an alternative. Open banking allows data to flow in a controlled way between organizations via an API, letting consumers and small businesses securely and efficiently transfer their financial data among financial institutions and accredited third party service providers. While Open Banking support is further ahead in Europe than the U.S. and Canada, this is changing with the emergence of the FDX specification and the recent Canadian mandate to introduce Open Banking by January 2023.

There are inherent risks to sharing data, and as financial services organizations switch to API-first approaches it is critical to develop governance processes around the privacy and security of personal data. One particular focal area is that the flow of data across open banking APIs must always be subject to express consent. In other words, consumers may be able to control what they share, when it is shared, and to whom the data is available.

To satisfy this, financial services must implement a fine-grained consent record that lets customers control who can access what information. Once a consent record is in place, dynamic authorization can be used to enforce the consent, performing a series of checks against each API request to confirm that the requestor has the appropriate consent to access the data.

PingAuthorize centralizes the consent enforcement function so that it's not embedded separately in every application. This allows the bank to provide a consistent layer of fine-grained authorization across all applications. Ultimately, this provides consumers with a more secure method of sharing their data, reduces the risk associated with screen scraping, and gives them a simple mechanism to control exactly how their data is shared. For the financial services organization, it improves security, visibility, brand trust and business agility. It’s a win-win for everyone involved.

Permissions and Entitlement

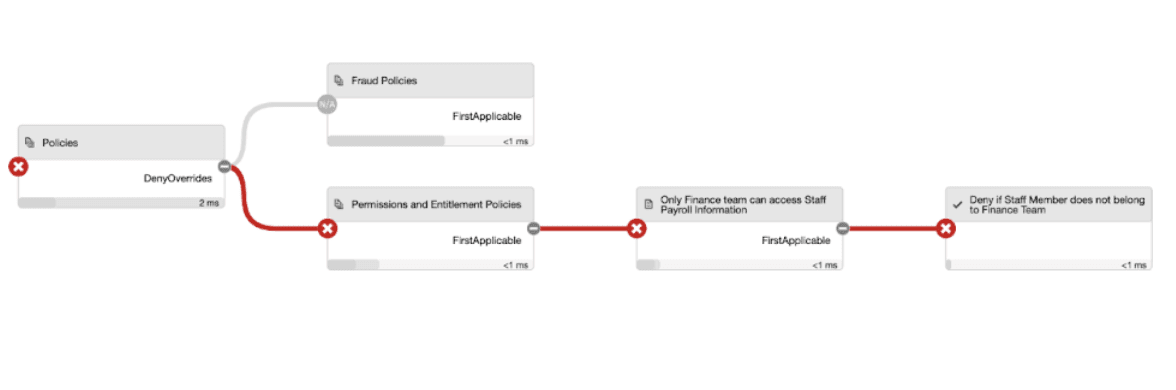

Financial services organizations have rules governing who can access what information and who can perform specific operations. In some cases, these rules are defined by applicable laws and regulations or by internal company policies. In other cases, to give customers flexibility and desirable experiences, financial services are creating rules for specific operations to allow customers to delegate access rights to other end users such as employees or relatives.

For example, in business banking a payment over a certain amount may require additional approval before processing. A staff member may be able to initiate the payment, but managers must approve them. In retail banking, a member of staff may only access accounts if the customer is serviced by the same branch or region as the employee, or a customer may have access to a minor’s account when they are the legal guardian of the account owner.

Here, authorization is determined by relationships between the user, the resources they are accessing and the action performed. This once meant creating separate role based access control (RBAC) policies to determine permissions for each category of staff and customer but this approach led to an onerous administrative burden around outdated permissions.

Dynamic authorization provides a more efficient solution. Permissions to perform actions on resources are expressed through explicit policies, drawing contextual entitlement information from relevant data stores. The organization explicitly defines relationships between customers, staff, resources and actions, quickly adapting without re-working static RBAC policies.

This creates better information security based around principles of least privilege. It improves user experience where only the objects and actions that a user can perform are displayed, and it gives the business a consistent, visible mechanism to implement the business rules governing access.

Conclusion

Dynamic authorization is the real-time enforcement of the fine-grained business logic around what users can see and do, in what context, and for what purpose. It isn’t based on static role-based logic like RBAC. Instead, it recognizes that the context of a transaction will often leverage numerous other risk signals and data sources to determine whether access is properly permitted. Dynamic Authorization solutions evaluate the latest data available and make an access decision at the time of the transaction.

The volume of customer data collected and stored by financial services organizations has grown rapidly due to recent world events. This presents new challenges to keeping information secure yet accessible. Financial services providers are implementing dynamic authorization to increase security and improve the user experience. Enterprise architects are adopting dynamic authorization as a core architectural component across the industry, which facilitates new use cases.

Ping Identity financial services customers employ dynamic authorization to prevent fraud, manage consent for open data regulations and control workforce permissions and entitlements. Our platform gives users the flexibility to easily update authorization policies and provides the foundation to implement dynamic authorization with each new use case a fiserv organization wishes to implement.

Dynamic authorization will continue to grow as a foundational piece of how enterprise systems are designed and built. That will improve both information security and the user experience, and continue to enable new use cases where institutions can take advantage of centralized, fine-grained control over who can access customer data and how consumers interact with your enterprise APIs.

To learn more about ABAC and Dynamic Authorization, read our white paper.

How Ping Serves the Financial Services Industry